Paycheck Fairness Act dies in Senate

November 23, 2010 — A unified Republican minority last week blocked a measure that would have made it easier for women to sue employers for pay discrimination, cheering business groups and disappointing advocates who said the bill could have helped to close the wage gap between men and women.

The law, known as the Paycheck Fairness Act, would have narrowed the defenses an employer can use to justify paying men more than women, and would have given women who win pay discrimination suits the opportunity to obtain uncapped punitive damages in some cases.

It also would have barred employers from punishing employees who ask about or disclose salary information — a protection that supporters said was essential to making employees feel free to bring pay disparities to light — and made it easier for women who have faced pay discrimination to bring class-action lawsuits.

What is story repair?

In this feature, we select a story that appeared in one or more major news outlets and try to show how a different set of inquiries or observations could have produced a more illuminating article. For repair this week: “Pay-Discrimination Bill Opposed by Business Fails in Senate Vote” (Bloomberg, Nov. 17).

Small businesses with annual revenues below $500,000 would have been exempt from many provisions of the act, as under current law.

The bill failed despite drawing support from a majority of senators. Under Senate rules, 60 senators must agree on procedural grounds to allow a law to come up for a simple majority vote; only 58 senators voted to allow the Paycheck Fairness Act to move forward. Every Republican senator opposed the measure, while every Democrat but one — Nebraska’s Ben Nelson — supported it.

The measure was passed by the House of Representatives in January 2009 alongside the Lilly Ledbetter Fair Pay Act, an effort to overturn a Supreme Court decision that had circumscribed women’s right to sue for pay discrimination. But while the Ledbetter bill quickly became law, the Paycheck Fairness Act, which received greater support from House Republicans, languished in the Senate for nearly two years before the Democratic leadership decided to push for a vote.

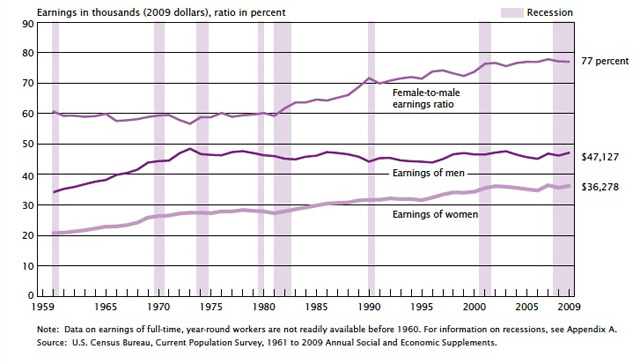

In the days before the Nov. 17 vote, senators faced a flurry of lobbying from both sides. Advocates, like the American Civil Liberties Union, said the law could have helped bring women’s earnings into line with men’s. Among full-time workers, women earn about 77 cents for every dollar made by a man, according to Census data.

While some of the discrepancy stems from differences in the industries in which men and women are concentrated, educational background, and work history, repeated studies have found that a wage gap persists even when controlling for these and other factors, although the amount attributable to discrimination remains a matter of dispute.

Federal law has prohibited wage discrimination on the basis of gender since 1963. But that law, known as the Equal Pay Act, “hasn’t been able to fulfill that promise of equal pay for equal work because of… weak enforcement and weak remedies,” said Deborah Vagins, legislative counsel for the ACLU.

The EPA permits pay discrepancies based on seniority, productivity, or merit, but also allows for differences caused by “any other factor other than sex.” The Paycheck Fairness Act would have required that the justification for a pay disparity be job-related and driven by “business necessity,” as is the case with some differences related to education or training. Some federal courts already interpret current law that way, but the change would have made that approach uniform, said Fatima Goss Graves, vice president for education and employment at the National Women’s Law Center.

The proposed law also would have created stiffer penalties for sex-based wage discrimination. Damages under the Equal Pay Act are generally limited to two or three years of back pay; a typical successful claim might lead to awards in the four- or five-figure range. Another anti-discrimination law, Title VII of the federal Civil Rights Act, allows plaintiffs to recover further compensatory damages, such as those for emotional distress, and also allows for punitive damages when employers are proven to have acted with “malice” or “reckless indifference” to the law, but caps total awards at $300,000 for the largest employers. (The caps are set at lower levels for smaller businesses.)

The Paycheck Fairness Act would have allowed plaintiffs to recover punitive damages under the malice or recklessness standard, as well as full compensatory damages, without imposing a statutory cap. Advocates said that would have put women on equal footing with victims of race-based pay discrimination, who can seek uncapped damages under a post-Civil War law that has been applied to workplace claims for several decades. (In practice, punitive awards in most cases are limited by Supreme Court doctrine to no more than 10 times the actual damages proven, a doctrine that would have applied to a revised EPA.)

The potential for greater damages, and the greater likelihood of class-action claims, would have created more incentives for employers to address problems with their pay practices, advocates said. Under current law, the risk of penalties “can really be incorporated in the cost of business for bad-acting employers,” said Goss Graves.

Supporters also said the ban on retaliation for sharing salary information was a needed change. In March, Stuart Ishimaru, then the acting chairman of the Equal Employment Opportunity Commission, testified before a Senate committee that that provision would have reduced barriers to identifying discrimination by addressing “the secrecy that surrounds pay information.”

But Michael Eastman, executive director for labor law policy at the U.S. Chamber of Commerce, said the law would have worsened what he called a flood of frivolous litigation faced by businesses.

Female-to-Male Earnings Ratio and Median Earnings of Full-Time, Year-Round Workers 15 Years and Older by Sex: 1960 to 2009

Source: U.S. Census Bureau, “Income, Poverty, and Health Insurance Coverage in the United States: 2009”