November 23, 2010 — A unified Republican minority last week blocked a measure that would have made it easier for women to sue employers for pay discrimination, cheering business groups and disappointing advocates who said the bill could have helped to close the wage gap between men and women.

The law, known as the Paycheck Fairness Act, would have narrowed the defenses an employer can use to justify paying men more than women, and would have given women who win pay discrimination suits the opportunity to obtain uncapped punitive damages in some cases.

It also would have barred employers from punishing employees who ask about or disclose salary information — a protection that supporters said was essential to making employees feel free to bring pay disparities to light — and made it easier for women who have faced pay discrimination to bring class-action lawsuits.

Small businesses with annual revenues below $500,000 would have been exempt from many provisions of the act, as under current law.

The bill failed despite drawing support from a majority of senators. Under Senate rules, 60 senators must agree on procedural grounds to allow a law to come up for a simple majority vote; only 58 senators voted to allow the Paycheck Fairness Act to move forward. Every Republican senator opposed the measure, while every Democrat but one — Nebraska’s Ben Nelson — supported it.

The measure was passed by the House of Representatives in January 2009 alongside the Lilly Ledbetter Fair Pay Act, an effort to overturn a Supreme Court decision that had circumscribed women’s right to sue for pay discrimination. But while the Ledbetter bill quickly became law, the Paycheck Fairness Act, which received greater support from House Republicans, languished in the Senate for nearly two years before the Democratic leadership decided to push for a vote.

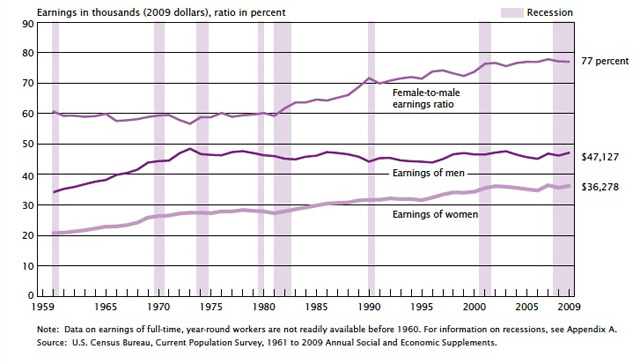

In the days before the Nov. 17 vote, senators faced a flurry of lobbying from both sides. Advocates, like the American Civil Liberties Union, said the law could have helped bring women’s earnings into line with men’s. Among full-time workers, women earn about 77 cents for every dollar made by a man, according to Census data.

While some of the discrepancy stems from differences in the industries in which men and women are concentrated, educational background, and work history, repeated studies have found that a wage gap persists even when controlling for these and other factors, although the amount attributable to discrimination remains a matter of dispute.

Federal law has prohibited wage discrimination on the basis of gender since 1963. But that law, known as the Equal Pay Act, “hasn’t been able to fulfill that promise of equal pay for equal work because of… weak enforcement and weak remedies,” said Deborah Vagins, legislative counsel for the ACLU.

The EPA permits pay discrepancies based on seniority, productivity, or merit, but also allows for differences caused by “any other factor other than sex.” The Paycheck Fairness Act would have required that the justification for a pay disparity be job-related and driven by “business necessity,” as is the case with some differences related to education or training. Some federal courts already interpret current law that way, but the change would have made that approach uniform, said Fatima Goss Graves, vice president for education and employment at the National Women’s Law Center.

The proposed law also would have created stiffer penalties for sex-based wage discrimination. Damages under the Equal Pay Act are generally limited to two or three years of back pay; a typical successful claim might lead to awards in the four- or five-figure range. Another anti-discrimination law, Title VII of the federal Civil Rights Act, allows plaintiffs to recover further compensatory damages, such as those for emotional distress, and also allows for punitive damages when employers are proven to have acted with “malice” or “reckless indifference” to the law, but caps total awards at $300,000 for the largest employers. (The caps are set at lower levels for smaller businesses.)

The Paycheck Fairness Act would have allowed plaintiffs to recover punitive damages under the malice or recklessness standard, as well as full compensatory damages, without imposing a statutory cap. Advocates said that would have put women on equal footing with victims of race-based pay discrimination, who can seek uncapped damages under a post-Civil War law that has been applied to workplace claims for several decades. (In practice, punitive awards in most cases are limited by Supreme Court doctrine to no more than 10 times the actual damages proven, a doctrine that would have applied to a revised EPA.)

The potential for greater damages, and the greater likelihood of class-action claims, would have created more incentives for employers to address problems with their pay practices, advocates said. Under current law, the risk of penalties “can really be incorporated in the cost of business for bad-acting employers,” said Goss Graves.

Supporters also said the ban on retaliation for sharing salary information was a needed change. In March, Stuart Ishimaru, then the acting chairman of the Equal Employment Opportunity Commission, testified before a Senate committee that that provision would have reduced barriers to identifying discrimination by addressing “the secrecy that surrounds pay information.”

But Michael Eastman, executive director for labor law policy at the U.S. Chamber of Commerce, said the law would have worsened what he called a flood of frivolous litigation faced by businesses.

The number of pay discrimination complaints handled by federal courts nearly tripled after Congress created the opportunity for punitive damages in 1991, he noted, but the Equal Employment Opportunity Commission finds no evidence of discrimination in about 60 percent of cases, and others are closed for administrative reasons. Chamber members report anecdotally that it costs about $25,000 to $50,000 to investigate and defend a routine complaint, Eastman said.

Eastman said the law rested on a faulty assumption that the unexplained parts of the wage gap are caused principally by employer discrimination, and he warned that the law would have prohibited pay practices that should be legitimate, such as paying higher salaries to employees who agree to work in hazardous locations, or who successfully negotiate for more pay. And while he agreed the law would have strengthened the EEOC’s hand, “they’re not an agency that deserves more leverage” because they do not always treat employers in good faith, he said. (Eastman added that the non-retaliation provision was not at the center of the Chamber’s objections.)

Advocates replied that many pay discrepancies would still have been allowed under the measure, as long as there was a true business-related reason for them. But they said some practices deserve more scrutiny: for example, experiments have found that women are viewed less favorably than men when they try to negotiate.

And, they said, warnings about frivolous litigation are raised every time Congress considers new anti-discrimination measures. “That is the same old story we’ve heard ever since the Civil Rights Act of 1964,” said Cheryl Polydor, an advocacy fellow with the National Employment Lawyers Association.

Kevin Clermont, a law professor at Columbia University who has studied employment litigation, said it was hard to know what share of the complaints that do not succeed are frivolous. But it is clear, he said, that employment discrimination plaintiffs in general lose much more than other plaintiffs, and it does not appear that the level of discrimination is falling sharply. His own view, Clermont said, is that “I do not think the courts are treating the plaintiffs fairly,” but that the best reform would be to educate judges better.

In the end, the arguments against the bill convinced just enough senators. Susan Collins and Olympia Snowe of Maine, two of the Senate Republicans who had voted for the Ledbetter Act, voted not to allow a final vote on the merits of the bill. Neither responded to requests for comment.

Kay Bailey Hutchison of Texas, who also supported the Ledbetter Act, said in a statement she opposed the recent measure because it allowed uncapped punitive damages even in cases of “unintentional discrimination.” The Senator’s claim does not acknowledge that punitive damages would not have been available in any case — intentional or otherwise — where the victim could not prove her employer had at least acted recklessly with respect to its legal obligations.

She also said the measure would have undermined performance-based pay programs, a statement that advocates disputed. Hutchison could not be reached for further comment.

Goss Graves of the National Women’s Law Center said the defeat was especially disheartening given the level of support the bill attracted. “It’s a really hard thing to explain, how getting 58 percent means that you lost a vote,” she said.