Lots of hostages will be taken on tax issues this year

|

By

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Integer nec odio. Praesent libero. Sed cursus ante dapibus diam. Sed nisi. Nulla quis sem at nibh elementum imperdiet. Duis sagittis ipsum.

“Taxmageddon”? No, just a reprise of giving in to hostage-takers

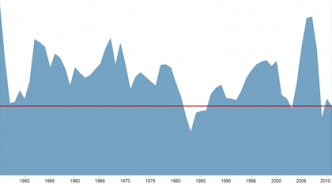

An NYT piece suggests that unprecedented tax hikes for all Americans may be coming in January. In fact, what we have is basically a rerun of 2010. The central question once again: will President Obama stand up to the GOP and allow tax rates on the wealthiest Americans to return, as scheduled, to their Clinton-era levels?

How fiscally prudent is "lower the rate and broaden the base"?

It's the corporate tax reform mantra these days — at least on the Democratic side of the aisle. But serious questions have been raised about the underlying premises, fiscal prudence, and ultimate revenue neutrality of proceeding concurrently.

Why are taxpayers helping companies pay for all their litigation?

An important benefit to one class of litigants is deeply baked into the current system. The tax code provides that businesses may deduct all of their legal expenses (lawyer and expert fees, and discovery costs) in all cases — win or lose, meritorious or non-meritorious, plaintiff or defendant.

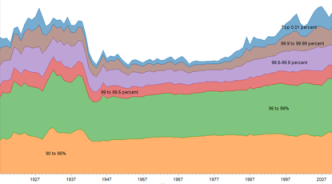

Cuomo to the 1 percent: here's a tax cut for Christmas

If you have an adjusted gross income of $1.8 million, for example, and file a joint tax return, New York's Andrew Cuomo has engineered annual tax savings for you of $27,280 in future years.